This Week in Ag #105

You can’t live without insurance these days. You can’t get a home mortgage without it. Nor can you legally drive without it. And if you’re a corn or soybean grower, you really can’t farm without it. That’s why over 90% of commodity crop acres are insured with Federal Crop Insurance. But FCI is anything but a normal insurance policy. You might say it’s insurance in name only. That’s because it’s not really about loss prevention; FCI focuses on revenue protection, making it a critical risk-management and business management tool. As the name implies, revenue protection guarantees a set amount of income per acre regardless of what happens during the growing season (weather, pests or other events), or what happens to market prices, provided a crop was planted. There are two key components: Actual Production History (APH, which is documented yields over a period of time) and Projected Price per crop. During February, the average futures prices for December corn and November soybeans are calculated to determine the PP. That’s why the recent corn rally could not have come at a better time. It locked FCI corn prices in at $4.70/bu. Granted, that’s still $1.20 below the glory days of 2022-23. But it’s 3 cents above 2024 and much better than it was looking towards the end of last year. Historically speaking, it’s well above the 10-year average of $4.48. The same can’t be said for soybeans, which is set at $10.54, well below its 10-year average of $10.91. Farmers can purchase various levels of coverage, up to 85% of their calculated revenue. Of course, the higher the level of coverage, the higher the premium price. That said, the US government subsidizes about two-thirds of FCI premiums. This makes it a lightning rod among many taxpayer advocacy groups. Here’s how FCI works. Let’s say your average corn yield over the past five years is 220 bushels per acre (that’s about what it is in many parts of Illinois). At the maximum 85% coverage level, your guaranteed revenue would be $878.90 per acre, regardless of how your crop turns out. Non-land production average costs in Illinois are projected to average $741.75. So if you own your land, and keep costs in check, you can actually profit from FCI. This is why some farmers are hesitant to invest in their crop toward the end of the season. Under the scenario above, if a farmer projects top-end yields of 187 bu/A, or even slightly above, it would not pay to invest in his crop, even though it could make agronomic sense. March 15 is the deadline for farmers to apply for FCI.

New US Agriculture Secretary Brooke Rollins received a standing ovation when she was introduced at Commodity Classic on Sunday. Based on the standing-room-only crowd, which was lined up 45 minutes prior to her appearance, farmers definitively wanted to hear what she had to say. The tenor of her 30-minute oration resembled more of a campaign rally than a policy plan. She frequently cited how USDA is eliminating DEI initiatives and reducing government waste via DOGE, emphasizing “gone is the green new deal and DEI initiatives.” A term largely missing from her speech was climate, only mentioning it twice, in context of USDA no longer being driven by it. Totally missing from her remarks was any mention of 45z tax credits or aviation fuels. She did say they are working to make E15 more accessible, but largely avoided mention of biofuels, only to say the administration wants energy produced at home. She was hopeful to have a Farm Bill passed by the end of the year and pledged to work to that goal. She also told the crowd that she will work in tandem with RFK Jr, while promising that farmers will not have to compromise the way they farm. Her biggest ovation came when she declared the need to repeal the death tax. The most endearing part of the speech may have been when she referenced how she learned of her Cabinet appointment. She and her husband were traveling to Auburn for a football game to cheer for her alma mater, Texas A&M. They stopped their RV at a Walmart in Mississippi to load up on tailgate supplies, when she received a call from President Trump. We wish her the best of luck and we look forward to her working with farmers moving towards the future.

Related Posts

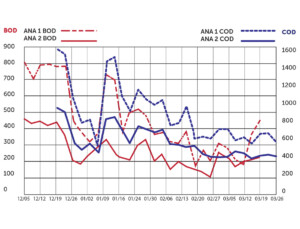

Bio Energizer® Reduces Cost and Turbidity in Paperboard Lagoons

A paper mill wastewater facility was treating 940 tons of paper bags, recycled linerboard, and corrugating medium, daily. The mill was interested in improving wastewater operating efficiency and lowering operating expenses over their standard polymer usage. The plant was experiencing filamentous bacteria, solids, and bulking issues in the final clarifier. It was discharging 4,000 pounds

The Great Beef Brawl: Cowboys vs. Politicians

Tempers flared across the beef belt last week as news broke that the U.S. may import Argentine beef, and ranchers weren’t having it. What followed felt like an old western saloon brawl between cowboys and politicians, complete with economic punches, market swings, and a whole lot of pride on the line.

The South Is Sweating and So Is The Corn

Just step outside. It's brutal. You’ll instantly know it’s “sweating season” across the South and much of the Midwest. Sure, temperatures are hot, consistently now in the upper 90s across the Delta. But it’s the humidity that instantly gets your attention and triggers sweat glands overload. The dew point - aka "the misery index" - indicates the temperature where dew forms: the higher the dew point, the more moisture is in the air. The National Weather Service defines dew points above 75 degrees as “oppressive.” That’s where we’ve consistently been across the Delta; most days reaching the upper 70s.