Regenerative agriculture is not some passing fad. It’s now a movement. And it’s here to stay. How can we be sure? Just look at who’s driving it. Unlike well-intentioned predecessors, such as LISA (Low Input Sustainable Agriculture), regen ag has a financial benefactor: food companies. From lofty goals articulated by their CEOs to multi-million-dollar investments, consumer brands are rushing to attach their name to nature-based growing practices.

Consider what’s been announced in recent weeks. Pepsico, North America’s largest food and beverage company, is investing $216 million in partnerships with farmer-facing organizations – Illinois Corn Growers Association, Practical Farmers of Iowa and Soil and Water Outcomes fund – to drive the adoption of regen ag practices. Cargill and Nestle are teaming with the National Fish and Wildlife Foundation and investing $15 million to support regenerative ranching practices across 1.7 million acres over the next five years. Archer Daniels Midland is taking things a step further, banking that consumers will support not just how their food is grown, but who grows it. ADM is launching Knwble Grwn, a brand of plant-based products grown by smaller-sized farmers and underrepresented farmers such as veterans, Indigenous Americans and other minorities, using regen ag practices. The branding of regen ag has the potential to reshape the entire food system and provide financial opportunities for all types of growers. The movement also elevates the role of natural-based products such as humates that foster soil health and lessen the reliance on synthetic molecules.

Combines continue to roll across Brazilian soybean fields, with three-quarters of the harvest completed. The world’s largest soybean producer is expecting record production of 5.56 million bushels, 21% higher than the last cycle and over 440,000 more than the 2020/21 record. While yields are returning to historical trends of around 52 bu/A after last year’s drought, a 5% expansion in soybean acreage has heightened Brazil’s production numbers. The same can’t be said of its neighbors. Argentina is experiencing the worst output in 20 years, and numbers in Paraguay and Uruguay are in steep decline. Overall, on the strength of Brazil, South America – which accounts for 55% of the world’s soy supply – should exceed last cycle’s levels, but less than estimated. In the USA, soybean markets remain strong, with inland elevators bidding over $15 per bushel.

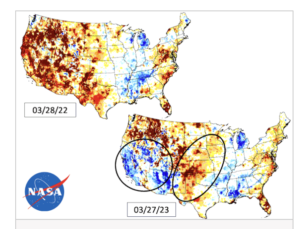

What a difference a year makes. We’ve seen startling images from California reservoirs that not only remove the drought label but foretell flooding this summer. This could offer a whole new set of challenges. The Sierra Nevada mountains snowpack water is now 239% above average. NASA maps of root zone moisture (which measures the top meter of soil) show a dramatic turnaround in California, Arizona, Utah and Nevada. But as you look east, it’s a much different story. Much of the central Plains have root zone moisture levels 75% below normal, as dry conditions persist in these areas.

Related Posts

Field Trial: Promax® and Zap® Reduce Nematodes, Increase Yields for Green Chiles

A recent field trial on green chile peppers has concluded that Promax® and Zap® treatment is noticeably effective in lowering the parasitic nematode population while improving the beneficial microbe population. This positive effect on the soil biology boosted the yield of green chile peppers and resulted in an increased profit for the farmer.

The Water Break Podcast, Episode 29: Preventing Backflow, Part 2

“Where we bridge the gap between water plant operators and engineers” In episode 29 of the Water Break Podcast, Heather Jennings, PE, discusses fundamental water systems backflow and cross-connection issues with Gary McLaren, Marketing Director and “Backflow Nerd” at HydroCorp, based in Troy, Michigan, and Rich Davison, Engineering Sales at Soderholm & Associates in Madison,...

Heather Jennings Is Featured Guest on “Better Together” Podcast

Paper360, a bimonthly magazine for the pulp & paper industry, produces a podcast called “Better Together: Conversations With Innovative Leaders.” At a recent podcast recorded live at SuperCorrExpo in Orlando, Fla., Heather Jennings, Director of Probiotic Solutions and Host of our own Water Break Podcast, was interviewed on the topic of diversity and innovation for...