This Week In Ag #135

Slow news weeks are few and far between these days. And agriculture is no exception. Much of last week’s happenings were more of a confirmation than a revelation. NCGA released results from a member survey that revealed nearly half of corn growers feel we are on the brink of a farm crisis. To anyone paying attention (or who reads TWIA), this is certainly not news. As we moved from the fantasy land known as 2022, commodity prices dropped in half, while overall input costs have exploded. Just this decade, machinery and labor costs are up over 45%, electricity and fertilizer over 35%, seed 18% and interest expenses 73%.

On average, corn growers are expected to lose 85 cents per bushel in 2025. From what I heard last week in California, specialty crop growers aren’t faring too well either. This prompted yet another round of layoffs at John Deere last week, tallying 2,200 jobs lost at Deere’s Iowa factories during the past 18 months.

As TWIA recently predicted, USDA is now taking further action. Last week, it was announced that another $13 billion in farm aid will go to US producers. It was noted that these funds will come from the collection of tariffs. Reliance on subsidies is nothing new to farmers. It’s been a common practice since the Dust Bowl, ebbing and flowing based on economic conditions and federal policy decisions. In 2020, growers received $46 billion in farm aid, accounting for nearly 40% of all farm income, due to COVID and trade disputes. Look for that trend to continue.

But the administration is not stopping at subsidies. The DOJ is now examining high input costs and the potential role of antitrust violations. Four companies (Nutrien, Yara, CF Industries and Koch) control about three-quarters of all US fertilizer production; three life science companies (Corteva, Bayer and Syngenta) control three-quarters of all corn and soybean seed sales. USDA is working with the DOJ to scrutinize competitive conditions in the ag marketplace and explore options for relief to farmers.

Oh, and in addition to all this news, harvest season is in full swing.

Makes you wonder what this week will bring.

Related Posts

Mighty Micronutrients – Q&A with CMO Fred Nichols

Fred Nichols, Chief Sales and Marketing Officer at Huma®, shared his perspective in a recent article on micronutrient technology, published in CropLife. In the article, Fred discusses how advancements in micronutrient formulations are meeting increased demand, improving nutrient availability, and enhancing crop performance. Below are the key topics along with Fred’s insights.

Research Report: Huma Gro® X-Tend® B Improves Barley Yield with a ROI of 38:1

In research conducted at the University of Idaho, Huma Gro® X-Tend® B, powered by Micro Carbon Technology® (MCT), has proven to improve barley yield. The boost in production led to a higher net gain per acre with a return on investment (ROI) of 38:1.

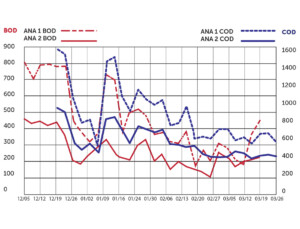

Bio Energizer® Reduces Cost and Turbidity in Paperboard Lagoons

A paper mill wastewater facility was treating 940 tons of paper bags, recycled linerboard, and corrugating medium, daily. The mill was interested in improving wastewater operating efficiency and lowering operating expenses over their standard polymer usage. The plant was experiencing filamentous bacteria, solids, and bulking issues in the final clarifier. It was discharging 4,000 pounds